Tesla CEO Elon Musk was enraged after a Delaware court voided his 2018 compensation plan this week and has called upon other companies to not incorporate in the state. However, while Musk might have reasons to be annoyed with the state, it’s the preferred state for over 65% of Fortune 500 companies.

For context, Chancery Court Judge Kathaleen McCormick struck down Musk’s 2018 compensation, under which he would have earned a mammoth $55.8 billion because she believed he had too much control over the board and shareholders. If it had come to pass it would be the highest CEO compensation in history by a large margin. The generous compensation coupled with the steep rise in Tesla stock (along with the rise in the valuation of SpaceX) propelled Musk to the position of the world’s richest person in 2021.

He also reached the milestone of becoming the first ever to have a net worth of over $300 billion (though his net worth has fallen dramatically since as Tesla’s stock has tumbled).

More Muskian Shenanigans Afoot

After the court ruling, Musk held an X (formerly Twitter) poll on whether the company should change its state of incorporation to Texas, where it also has its headquarters. The majority of respondents responded in the affirmative and Musk said, “Tesla will move immediately to hold a shareholder vote.”

Should Tesla change its state of incorporation to Texas, home of its physical headquarters?

— Elon Musk (@elonmusk) January 31, 2024

The move was ridiculed as a spiteful retaliation against the state of Delaware for refusing him the craziest payment package anyone has ever laid their eyes on. Though he does have a point. The courts rejecting a package approved by 80% of shareholders is essentially unprecedented and may threaten the capitalist principle of shareholder democracy.

Whether Musk and the Tesla board will actually go through with the move to Texas is uncertain.

The controversial figure has usually followed these polls when it suits him. For instance, while he sold Tesla shares in 2021 after a Twitter poll, he almost certainly would have been forced to sell them anyway as he faced a massive tax bill related to his stock options.

However, despite a 2021 Twitter poll being overwhelmingly in favor of Tesla accepting dogecoins as a payment, Musk did not honor that poll (for the most part) as the volatile meme cryptocurrency could have played havoc with Tesla’s profits. Later that year though the company started accepting dogecoin for merchandise which accounts for a tiny fraction of its overall revenues.

Why Does Musk Hate Delaware?

Musk has his own reason to hate Delaware. $55.8 billion is not a small sum after all, even for one of the richest people alive. Also, the court voiding Musk’s previous compensation is a major blow to the new compensation structure that he has been pushing the board for as well as every future package he negotiates. The decision could (and likely will) cost him tens of billions of dollars in the long term.

Incidentally, a few days before the court ruling, Musk warned in a tweet that unless he has a controlling stake in Tesla, he won’t be comfortable building AI products at the company.

Musk seldom shies away from controversies and has faced many legal battles over the last few years. However, many label him as “Teflon” Musk as he has prevailed in the legal battles.

He faced a suit over Tesla’s acquisition of Solar City but won the legal battle. British caver Vernon Unsworth also filed a defamation case against Musk when he called him a “pedo guy” in a Tweet. The jury eventually decided that Musk did not defame Unsworth.

He also won a class action lawsuit that a group of stockholders had filed over his controversial 2018 tweet about taking the company private.

Musk even successfully pressured officials to open Tesla’s Freemont factory at the height of the COVID-19 pandemic. The mercurial CEO eventually shifted Tesla’s headquarters from California to Texas after criticizing the Golden State’s stringent regulations and taxes.

Is Delaware a Bad Place to Incorporate Your Company?

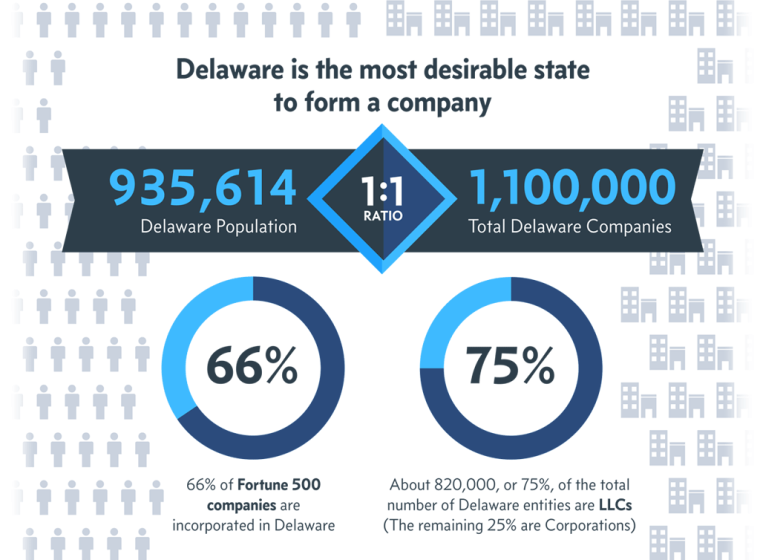

While Musk now doesn’t find Delaware as a worthy place to incorporate a company, the majority of business experts seem to disagree. Famously, there are more companies incorporated in Delaware than there are residents.

Over half of all publicly traded companies in the US and two-thirds of Fortune 500 companies are incorporated in the state – and for good reason.

The following are the main advantages of incorporating in Delaware

- It’s easy to incorporate in Delaware: It is extraordinarily easy to incorporate in Delaware and often the process can be completed within an hour.

- Tax benefits: The state does not impose income tax on companies that don’t do business in the state even if they are incorporated there.

- Legal support: Delaware has a Court of Chancery to specifically handle cases related to corporates. The same court actually ruled against Musk in the 2018 compensation case.

- Flexible and business-friendly laws: Delaware has the reputation of offering some of the most business-friendly legal environments in the US (even though Musk might not agree). The state also doesn’t tax royalty payments to business owners.

- Privacy: Companies incorporated in Delaware need not disclose the names of their directors and officers to the state which helps in maintaining anonymity and privacy.

- VCs and private equity investors prefer Delaware: VCs and private equity funds prefer companies incorporated in Delaware due to the state’s business-friendly environment. For startup companies aspiring to raise capital, Delaware therefore often becomes the first choice to incorporate. Also, state laws allow a single person to hold roles like officer, director, and shareholder, which makes it easier for smaller companies.

No wonder around 1.5 million companies have chosen to incorporate in Delaware even as the state ranks on the top end when it comes to corporate tax.

Which Other States Are Good to Incorporate Your Business In?

Nevada and Wyoming have also emerged as alternatives for incorporation as these states don’t have state income taxes. Texas too is trying to pitch itself as an alternative to Delaware and it recently decided to instate a new business court designed along the same lines as Delaware’s Court of Chancery in September.

That said, Musk’s desire to move Tesla’s incorporation from Delaware to Texas looks to be driven by the ruling against him rather than any concern for Tesla. This may put the company’s shareholders in an awkward position as it may be to their benefit to stay incorporated in Delaware.

Danilo Kawasaki, co-founder and chief operating officer of Gerber Kawasaki Wealth and Investment Management in California which has invested around $100 million in Tesla shares is not too pleased with Tesla considering a Texas incorporation and said, “We think that the big concern is Elon Musk thinking that he can do whatever he wants.” This is essentially why Judge McCormick struck down his pay package and moving the company to Texas on a whim isn’t helping his image.

Kawasaki went on to say that Musk is “not dealing with the problem at hand, which is good corporate governance,” while adding that the court ruling could have been “an opportunity to make Tesla better for shareholders.”

Brian Cheffins, a professor of corporate law at Cambridge University believes that Texas might not offer what Musk might be looking for.

“Musk must believe that Texas judges are more ‘business friendly’ than their Delaware counterparts… Musk must be assuming that Texas judges will…take a more relaxed approach to the issue than Delaware judges,” said Cheffins. He however added, “It is far from clear Texas judges will do so.”