Some of the largest United States banks are bracing themselves for some significant losses coming out of their portfolio of personal loans and credit cards as indicated by their financial reports covering the second quarter of 2024.

JPMorgan Chase, one of the country’s largest banks set aside nearly $1.2 billion from its revenues to raise its loan loss provision to a staggering amount of $3 billion.

Also read: JPMorgan & BoA Write Off Billions as Delinquencies Skyrocket- Is a Bank Crisis Ahead?

They are not alone in this initiative as other big financial institutions like Bank of America and Wells Fargo are taking similar actions, with the forming increasing its provisions from $1.3 billion to $1.5 billion in the last quarter while the latter bolstered its reserves by $300 million to $1.2 billion.

Understanding the Trend: What Are Banks Preparing for?

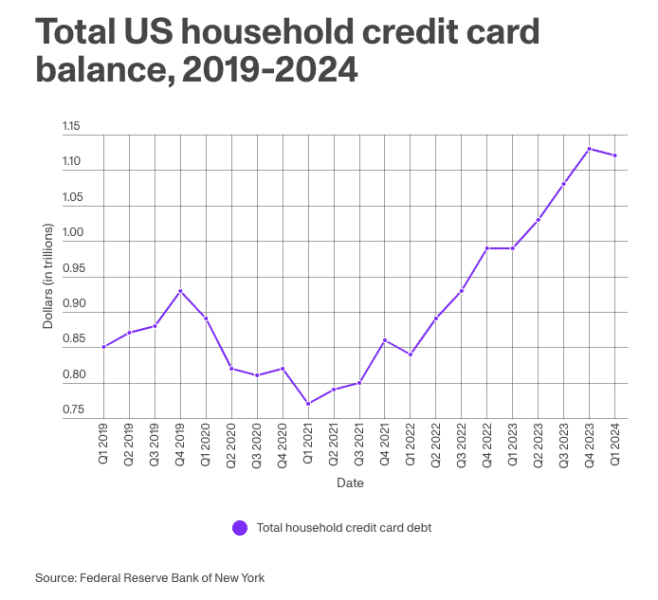

The alarming rise in consumer debt is the primary driver for this cautious approach by banks. According to data from TransUnion, credit card balances in the United States have exceeded $1 trillion already. This increase has raised red flags among financial institutions.

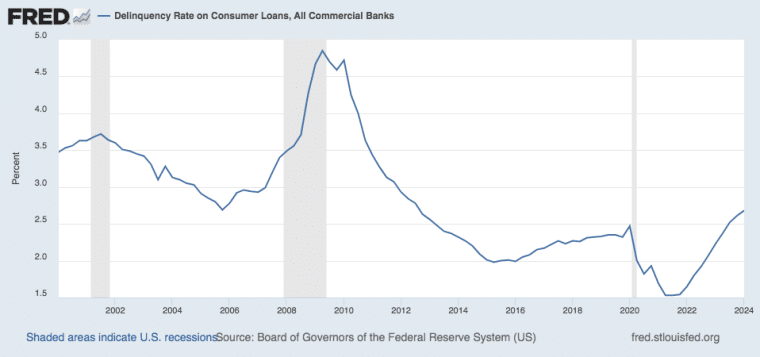

Moreover, delinquency rates in the country are also ticking higher.

Data from the St. Louis Federal Reserve shows that delinquency rates for consumer loans within the country have been increasing since the first quarter of 2022, back when the Federal Reserve started to increase interest rates aggressively to stop inflation from spiraling out of control.

The percentage of delinquent accounts back in Q1 2022 was 1.65% while it now sits at 2.68% as of the end of the first quarter of 2024.

Meanwhile, total US household debt has reached a frightening level at nearly $18 billion including $12 trillion in mortgage balances and $1.6 trillion in auto loans.

The commercial real estate sector has also shown signs of distress and is adding an extra layer of risk to banks’ balance sheet. One major catalyst for this situation has been the rise of remote work as this resulted in a dramatic decline in the demand for office space.

Bank of America’s Q2 earnings report provides a glimpse of how bad the situation is getting as, aside from setting aside more money for future loan losses, its net charge-offs – which is money that the bank does not expect to recover – nearly doubled from $869 million to as much as $1.5 billion in just 12 months.

A similar trend was spotted in JPMorgan Chase’s earnings report as the bank’s Consumer & Community Banking unit booked net charge-offs of $2.1 billion resulting in an $813 million increase compared to a year ago.

“The fact that we see more people carrying balances for a longer period of time, and now more people falling behind, is evidence of the struggle that millions of households are engaged in just trying to make ends meet,” commented Greg McBride from the personal finance company Bankrate.

Other Factors Contributing to Rising Credit Loss Provisions

Aside from an increase in delinquencies, a couple of other factors are prompting banks to increase their loan loss provisions including the normalization of its balance sheet after the distortions caused by the pandemic and a decline in the amount of deposits they hold as consumers have gone back to their usual spending habits now that the health crisis is over.

Moreover, the Federal Reserve conducted a stress test in June 2024. The assessment found that banks needed to increase their provisions for Commercial & Industrial (C&I) loans as delinquencies in this segment are expected to rise in the following quarters.

Brian Riley, Co-Head of Payments at Javelin Strategy & Research, commented: “The increase in loan loss reserves from Chase and Bank of America is indicative of an expected increase in losses. Funding loan losses in advance of the occurrence is the best practice for card issuers because it prepares their balance sheet for upcoming losses.”

Cautious Banks are Bad for the Economy

Following a prolonged period of rate hikes, the Federal Reserve has now taken a pause and could soon start cutting the Federal Funds Rate for the first time since 2020 as inflation is getting closer to the central bank’s target of 2%.

However, the impact of these hikes in consumer finances has been dramatic and is leaving a trail of delinquent accounts that banks’ balance sheets are starting to assimilate.

Despite a more favorable macroeconomic landscape, banks could tighten their lending standards and impose more strict conditions on consumers and businesses which could lead to slower economic growth.

Risk-averse banks are bad for the economy as it means fewer mortgages, lower credit limits for credit cards, higher annual percentage rates (APRs), and other similar restrictive policies.

Credit Card Delinquencies Hit 12-Year High

In the past couple of years, high inflation led to an increase in consumers’ reliance on credit to cover their essential expenses at a point when credit card interest rates were at a record higher due to the Fed’s rate hikes.

Now, delinquency rates on consumer loans are sitting at their highest levels in 12 years and banks are worried. Has the economy improved enough for consumers to repay their delinquent accounts? Analysts believe that this is an unlikely scenario.

“Interest rates took the elevator going up, but they’re going to take the stairs going down,” Bankrate’s McBride asserts.

So, even if the Fed cuts interest rates in the following quarters, consumers will not see a significant reduction in their payments on short notice necessarily as banks may decide to keep rates high due to the higher risks they are assuming now that a key Fed liquidity program is no longer available.

Moreover, the economy may have been improving but it is still too soon to say if the US is completely out of the woods. Banks are taking every precaution possible to avoid being swept into a situation where negative macroeconomic changes can affect their financial stability and this will probably result in stricter credit policies.

The Fed’s Program to Protect Banks from Failing Was Shut Down in March 2024

In March, banks also saw the end of the Federal Reserve’s Bank Term Funding Program (BTFP) – a temporary program created by the central bank to aid financial institutions during a period of distress when regional institutions like the Silicon Valley Bank and Signature Bank went out of business.

The end of BTFP should not result in the collapse of other banks but it could prompt institutions to tighten their credit policies, impose higher interest rates on consumers, and increase their loan loss reserves.

The Federal Reserve’s quantitative tightening program, which involves selling bonds and removing liquidity from the financial system, is another factor to consider. The Fed has been allowing a significant amount of Treasury bonds to mature without replacing them.

The leaders of top financial institutions, including Jamie Dimon from JPMorgan Chase, were worried about this as it rapidly reduced the Fed’s balance sheet at a point when a soft landing was unclear.

To ease these concerns, the Fed is now reducing the amount of assets that it lets mature to just $25 billion. It is unlikely that they will reaccelerate quantitative tightening, but the fact that they are still letting bonds be repaid without replacing them shrinks the monetary supply and affects banks’ deposits and the overall liquidity of the United States financial system.

Wrapping Up

To sum up, the significant increase in loan loss provisions by major US banks in 2024 suggests that they are preparing for further increases in the amount that they are forced to write off their balance sheets as a result of higher delinquencies. Despite the market’s expectation of interest rate cuts and falling inflation, banks appear to be bracing for:

- Increased credit defaults and delinquencies across various loan types.

- Potential stress in the commercial real estate sector.

- A potential economic slowdown as credit availability tightens.

While these preparations don’t necessarily predict an imminent crisis, they indicate a cautious outlook from the banking sector for the U.S. economy. As the Federal Reserve navigates the delicate balance between controlling inflation and supporting economic growth, the actions of major banks serve as a barometer to understand the potential economic challenges that lay ahead.