After nearly a decade of waiting, creditors of the bankrupted Japanese crypto exchange Mt. Gox will finally receive the BTC and BCH tokens they once deposited many years ago, marking the conclusion of a lengthy bankruptcy proceeding.

While this is positive news for those affected by the exchange’s shutdown, other crypto investors are preparing for how this event might influence the price of Bitcoin (BTC), as nearly $9 billion in BTC tokens will flood the market once payments begin.

According to reports from crypto analytics firms today, a wallet that was associated with Mt. Gox originally reportedly moved $2.84 billion worth of BTC tokens (44,527 coins) to another wallet that may be used internally.

Investors have interpreted the move as a sign that Mt. Gox could be getting ready to start transferring the first batch of crypto payments to creditors and this has triggered fears of a BTC sell-off.

The Mt. Gox Bankruptcy: A Decade-Long Saga

Founded in 2010 by Jed McCaleb, the Tokyo-based company quickly gained popularity among crypto enthusiasts and reportedly handled around 70% of all Bitcoin trading volume by 2013. However, the exchange’s rapid rise was cut short in February 2014 when it suddenly suspended trading, closed its website, and filed for bankruptcy protection.

The cause of Mt. Gox’s downfall was a massive hack that resulted in the loss of approximately 740,000 BTC tokens owned by its customers as well as 100,000 bitcoins owned by the exchange itself. At the time, the value of this theft was estimated at $460 million and represented around 7% of all the Bitcoin tokens in circulation.

Five Exchanges Appointed to Distribute Mt. Gox’s Repayments

The bankruptcy proceedings involving Mt. Gox and its creditors have been quite complex. Initially, the case followed a traditional path where customers filed their claims based on the value of their BTC holdings as of 2014 expressed in Japanese yen. However, the significant increase that the price of BTC experienced throughout the years forced customers to file a civil claim that would allow them to benefit from this appreciation.

The person responsible for overseeing and distributing the assets owned by Mt. Gox was Nobuaki Kobayashi, who was appointed by the court to this noble – yet challenging – task at a moment when high-profile bankruptcies involving digital assets were nearly unprecedented.

In June 2024, the trustee announced that, upon overcoming several hurdles, the repayment process would commence the month after.

Five crypto exchanges were appointed to assist Mt. Gox in transferring the crypto payments to their rightful owners including Bitstamp, Bitbank, BitGo, Kraken, and SBI VC Trade. Thus far, Bitstamp has been the only one that has confirmed the reception of Mt. Gox’s funds. The exchange commented that repayments will start in the next two weeks.

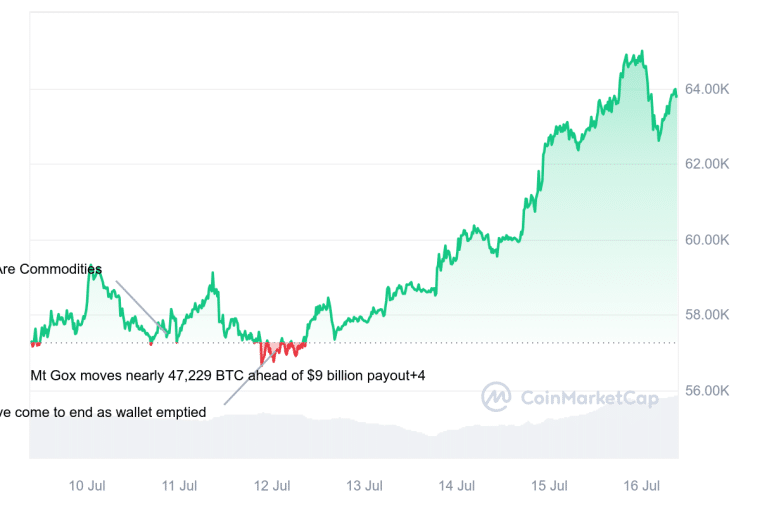

BTC Briefly Dips but Recovers After Trump Appoints Crypto-Friendly VP

The large transfers made by Mt. Gox’s trustees between wallets linked to the failed exchange quickly prompted a decline in the value of BTC of around 3% earlier in the day. However, the drop was quickly reversed with the cryptocurrency now generating 2% gains in the past 24 hours.

The market’s reaction appears to be driven by fears that these fresh funds could add some selling pressure from Mt. Gox creditors opting to liquidate at least a portion of their holdings after years of waiting. However, some analysts believe that the long-term impact may be less severe than initially anticipated.

“The pressure of Mt. Gox has been vastly overestimated as many creditors are long-term Bitcoin enthusiasts who are less likely to sell all of their Bitcoins immediately,” commented Lennix Lai from the crypto exchange OKX.

In the past 7 days, the price of BTC has climbed by more than 11%, partially aided by Donald Trump’s assassination attempt on Saturday. Investors realized that the failed attempt was a boon to Trump’s candidacy, who is generally considered to be more friendly to the crypto industry.

Willy Chuang, COO of crypto exchange WOO X, stated: “Mt. Gox moved 47,228 BTC, signaling the start of their repayment process, which has caused some market fear due to the large potential sell-off … However, it’s worth noting that despite these concerns, the long-term impact may be less severe as the market gradually absorbs the selling pressure.”

Meanwhile, the former president and Republican candidate for the upcoming election also picked Ohio Senator JD Vance as his running mate for the Vice-president role. Vance is a well-known supporter of the crypto industry and that may have also contributed to pushing the performance of digital assets to positive territory this morning despite the Mt. Gox scare.

Just overwhelmed with gratitude.

What an honor it is to run alongside President Donald J. Trump. He delivered peace and prosperity once, and with your help, he'll do it again.

Onward to victory!

— J.D. Vance (@JDVance1) July 16, 2024

The Price of Bitcoin Cash Could Drop Dramatically as Mt. Gox Will Distribute BCH As Well

Some analysts have been warning that BTC may not be the most affected token when Mt. Gox repayments start to be distributed. In this regard, they pointed to Bitcoin Cash (BCH), a Bitcoin hard fork, as the most likely major victim of the event.

According to court documents, aside from the $9 billion worth of BTC tokens that will be distributed, Mt. Gox creditors are also entitled to receive around 143,000 BCH tokens that are currently valued at $73 million. That figure represents almost a quarter of BCH’s trading volume.

“Our analysis shows that the selling pressure for BCH will be four times larger than for BTC: 24% of the daily trading value for BCH vs. 6% of the daily trading value for BTC,” commented Peter Chung, an analyst from Presto Labs this week.

The price of Bitcoin Cash (BCH) is declining by 1.5% as of this morning, possibly as the news have made investors aware of what could happen to the token once Mt. Gox’s payments start to go out.

Creditors Will Receive a Windfall After Years of Stress and Anxiety

For some of the recipients of Mt. Gox reimbursements, they had no other choice but to invest in cryptocurrencies for the long run as their holdings were locked up for more than a decade.

This has yielded positive results in some cases. For example, one creditor who lost a couple thousands of dollars worth of BTC will now receive over $70,000 based on today’s prices.

However, for others, the waiting period has been excruciating. Most of them have suffered at least some degree of financial hardship, anxiety, stress, and uncertainty as it was unclear for many years if they would receive the tokens they owned or a cash payment worth less than the current value of the tokens.

Mt. Gox’s case is an ever-present reminder that relying on centralized exchanges to deal with cryptocurrencies comes with risks. Especially if those institutions are not adequately regulated by authorities.

As the repayment process continues, the cryptocurrency market will likely experience some volatility in the following days considering the importance of the events that have taken place lately – i.e. Trump’s assassination attempt, the appointment of JD Vance, etc. Analysts and investors will be closely watching how Mt. Gox’s creditors behave shortly after they receive their widely-awaited assets.