Following a few weeks of overall weakness in the cryptocurrency market, the price of multiple meme coins has been resurging, primarily propelled by expectations that the Federal Reserve will soon implement the first interest rate cut since 2020.

Dogwifhat (WIF) is a prominent meme coin that has already jumped to the top of the charts within the crypto space, currently ranking at the 41st spot overall and 4th among meme coins with a market capitalization of $2.55 billion.

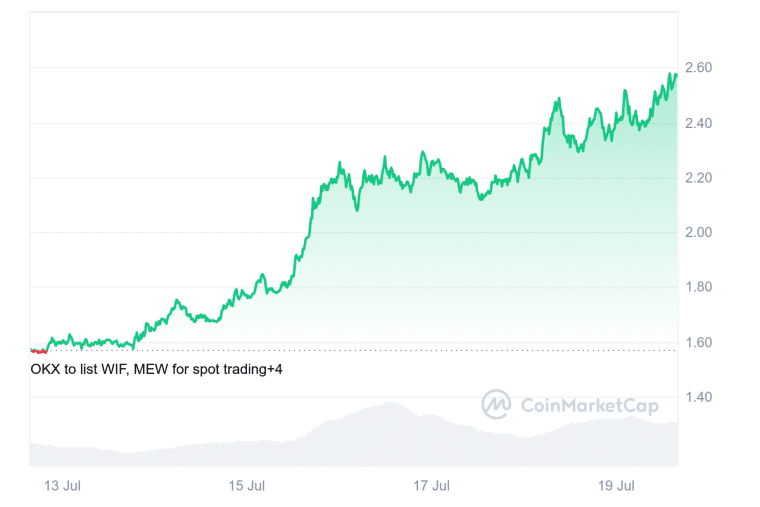

Since late June, its price has rebounded from around $1.8 per token – the lowest level booked since March this year – to $2.56 today, resulting in a 40% gain in a relatively short period.

However, in the past 7 days alone, WIF has delivered gains of 60%. Market watchers have indicated that both trading volumes and liquidity for this token have increased significantly and have exceeded the $500 million mark.

According to data from CoinMarketCap, $561 million worth of WIF tokens have been negotiated in the past 24 hours alone. The question that WIF holders and meme coin investors are asking is whether WIF’s gains will continue in the next few days or weeks.

Naturally, there are thousands of potential major variables that could cause WIF’s price to pump or crash so it’s impossible to make an exact prediction. However, with a strong understanding of the meme coin market and the context surrounding the recent volatility in the crypto market, you can make more informed decisions.

Trump’s Assassination Attempts Boost Odds of a Crypto-Friendly Presidency

The assassination attempt perpetrated against the former President of the United States, Donald Trump last Saturday contributed significantly to boosting the price of cryptocurrencies as a whole.

Trump is often seen as the best candidate for the crypto industry as he has mentioned multiple times that he is in favor of coming up with adequate regulation that helps the sector grow and move forward instead of limiting its boundaries, as he claims the Biden administration has done in these past 4 years.

Trump also picked a crypto-friendly Vice President, JD Vance. The Senator from Ohio recently pushed forward a bill that would create a comprehensive regulatory framework to both protect consumers and investors while ensuring that companies can thrive in the United States by offering crypto-related services.

The odds that Trump will win a second term in the Oval Office were boosted after his assassination attempt. According to wagers on the prediction market Polymarket, the Republican candidate now has a 66% chance of winning the race.

Meanwhile, bettors are increasingly expecting that Joe Biden will drop out of the race due to health conditions that were made obvious during his terrible performance in the latest televised debate against Trump.

If Biden does step down as the Democratic candidate for the November election, Trump’s odds will increase dramatically as a new candidate will have just a few weeks to campaign across the country.

Solana-Linked ETF Application Filed

Another catalyst that may have helped WIF skyrocket in the past few days is the rumors associated with applications being sent to the United States Securities and Exchange Commission (SEC) by asset management companies to list a Solana-linked spot exchange-traded fund (ETF).

On 27 June, VanEck filed an S-1 application and just a day after 21Shares – another asset management firm – did the same to list a spot ETF linked to the Solana (SOL) token.

Although the price of WIF reacted positively to that development, it soon dropped to its lower levels a few days later. However, the latest comments from the Federal Reserve’s Chairman, Jerome Powell, which indicated that the central bank was pleased with how the economy is performing lately, would have confirmed that macroeconomic conditions could soon improve.

An accommodative monetary policy (namely a series of rate cuts) would be exactly what meme coins need to recoup their lost territory and traders are apparently expecting an improvement in macro variables and are piling up on the most popular tokens in the space like WIF to prepare for that upcoming surge.

It’s important to note here that a rate cut wouldn’t assure a price increase from WIF or any other cryptocurrency. However, low rates are generally positive for higher-risk investments as low-risk investments like bonds and treasuries are much more enticing when interest rates are high.

Double-Bottom Technical Formation Would Confirm Bullish Outlook

Technical analysts have pointed out two elements on the WIF chart that support a bullish outlook for the token. The first is a double-bottom formation. This pattern results from the price bouncing off the same support level two times in a relatively short period.

For WIF, that support was found at $1.5 on June 24 and July 12 when the price decisively bounced off that mark. Since the second tag of that support line, the price has skyrocketed and is nearing an important area of resistance at $2.65.

If the price breaks above that zone, chances are that it could move to $3.5 and $4 in the following weeks, aided by these macroeconomic tailwinds and expectations that a SOL-linked ETF could be approved in the next few months.

Meanwhile, the MACD oscillator, a well-known technical indicator, has sent a buy signal recently and is moving to positive territory for the first time since June 9. This would indicate a trend reversal and reinforce a bullish short-term outlook.

Analysts have suggested that traders may be cashing out of the most recent gains they have seen on larger assets like Bitcoin (BTC) and Ethereum (ETH) and are moving their funds to segments of the crypto market that usually perform positively in a later stage.

What’s So Special About WIF?

One of the intriguing aspects of the latest surge in the price of WIF is that the magnitude of the increase has surpassed those of other well-established Solana-based tokens. For example, in the past 7 days, the price of PEPE rose 46% while BONK advanced only 43%.

Meanwhile, the price of another popular meme coin called Book of Meme (BOME), increased by 30% during this same period.

The asymmetry of WIF’s returns compared to other meme coins cannot be attributed to a specific event but WIF seems to regularly outpace the meme coin market. It often moves before its competitors, potentially because of its strong community.

Meme coins are well known for being one of the most volatile digital assets in the space. Since there are no obvious catalysts that would justify why WIF outperformed other meme coins, traders should approach with caution and make sure they have a plan to get in and out of their positions based on a sound technical thesis.